When planning a getaway, most travellers focus on flights, accommodations, and activities. But lurking in the fine print of many hotel bills is a charge that often catches visitors off guard: the resort tax.

This seemingly innocuous fee can add up quickly, turning a dream vacation into a budgetary headache.

Origins of Resort Taxes

Resort taxes, also known as facility fees or destination fees, originated in North America, particularly in tourist hotspots like Las Vegas and Miami. The practice began in the late 1990s as resorts sought ways to offset the costs of amenities such as pools, gyms, and Wi-Fi. By separating these charges from the advertised room rate, hotels could present lower prices to attract guests while still covering operational expenses.

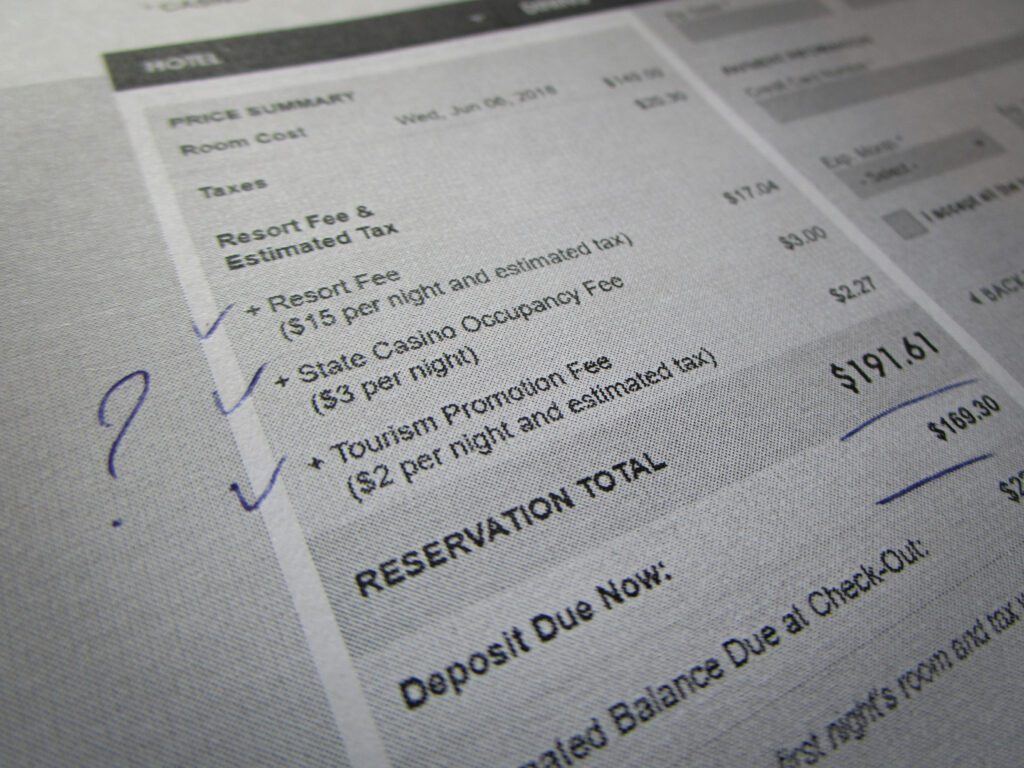

Having just returned from a memorable trip to Las Vegas, I couldn’t help but notice how the resort tax added quite a bit to my final bill. It’s a fee that often escapes the spotlight when planning a vacation but can make a noticeable dent in your budget, especially in destinations like Vegas where the charges are among the highest in the world.

What Are Resort Taxes For?

Hotels and resorts justify these fees as a way to maintain and enhance guest amenities. From spa access to shuttle services, resort taxes are marketed as covering the “extras” that elevate a stay. However, critics argue that these fees are often mandatory, regardless of whether guests use the facilities. In some cases, the charges cover basic services like air conditioning or housekeeping, which many believe should be included in the room rate.

Where Are Resort Taxes the Highest?

The United States leads the pack in resort tax charges, with cities like Honolulu imposing some of the steepest fees. In Honolulu, guests face a transient accommodations tax of 10.25%, plus a city surcharge of 3%, amounting to over £42 per night for an average hotel room. Other U.S. cities like San Francisco and Los Angeles also rank high, with nightly fees exceeding £20. In Europe, Amsterdam has the highest tourist levy, charging 12.5% of the overnight rate, plus additional fees for cruise passengers.

The Range in Price

Resort taxes vary widely depending on location and accommodation type. In the Caribbean, fees range from €13 to €45 per stay, while in Bhutan, visitors pay a daily fee of $100. European cities like Vienna and Brussels charge modest nightly rates of €3 to €7.50. These fees can be calculated as a flat rate per night, a percentage of the room rate, or a combination of both.

How Do Hotels Get Away With It?

The key to the persistence of resort taxes lies in their presentation. By advertising lower room rates and adding fees later, hotels can appear more competitive. Additionally, these charges often escape scrutiny because they are disclosed in the fine print or during check-out. Legal challenges have arisen in the U.S., with consumer protection groups advocating for transparent pricing. However, the hospitality industry has largely resisted reforms, citing the need to remain profitable in a competitive market.

Resort taxes are a hidden cost that travellers should be aware of when booking accommodations. While they may fund amenities and infrastructure, their mandatory nature and lack of transparency have sparked widespread criticism. As more destinations adopt these fees, understanding their origins, purposes, and variations can help travellers budget effectively and avoid unpleasant surprises. So, next time you book a hotel, take a closer look at the fine print- you might just uncover the hidden cost of paradise.