In the world of travel rewards, credit cards have become a powerful tool for savvy travelers looking to maximize their benefits. With a plethora of options available, understanding how to earn and redeem travel rewards can significantly enhance your travel experiences.

This ultimate guide will walk you through the essential strategies for earning credit card travel rewards, the best cards to consider, and how to choose the right card for your needs.

Understanding Travel Rewards

Travel rewards are points or miles earned through credit card spending that can be redeemed for travel-related expenses, such as flights, hotel stays, and car rentals. These rewards can also include perks like airport lounge access, free checked bags, and travel insurance, making them highly valuable for frequent travelers.

Choosing the Right Credit Card

When choosing a credit card for travel rewards, consider the following factors:

- Sign-Up Bonuses: Many credit cards offer lucrative sign-up bonuses for new users. These can often be enough for a free flight or hotel stay after meeting a minimum spending requirement.

- Earning Rates: Look for cards that offer higher rewards rates on categories you spend the most in, such as dining, travel, or groceries.

- Redemption Options: Some cards allow you to transfer points to airline and hotel partners, while others have fixed redemption rates. Understanding your options can help you get the most value from your points.

- Annual Fees: Weigh the benefits of the card against its annual fee. Some cards with higher fees offer substantial rewards that can offset the cost.

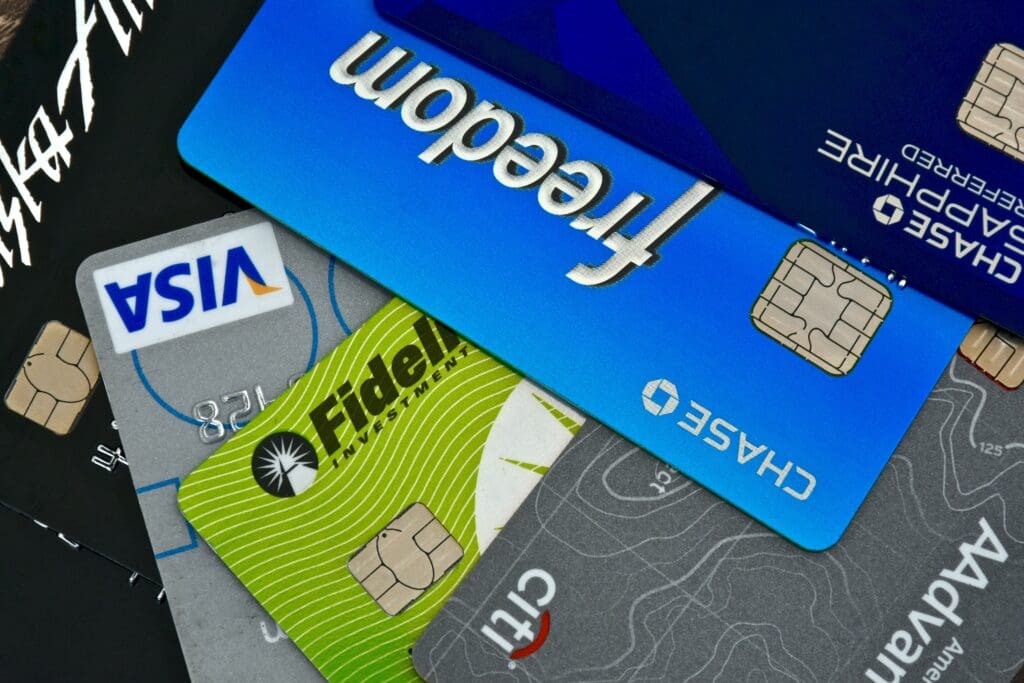

Top Credit Cards for Travel Rewards

1. Chase Sapphire Preferred

The Chase Sapphire Preferred card is a favorite among travel enthusiasts due to its generous sign-up bonus and flexible rewards program. Cardholders earn 2 points per dollar spent on travel and dining, and 1 point per dollar on all other purchases. The points can be transferred to numerous airline and hotel partners, which can enhance their value significantly.

2. Chase Freedom Unlimited

On the other hand, the Chase Freedom Unlimited card offers a straightforward rewards structure, providing 1.5% cash back on all purchases. While it is primarily a cash back card, its points can be converted into travel rewards if you also hold a Chase Sapphire Preferred card. This flexibility allows you to maximize your points potential when comparing chase sapphire preferred vs freedom unlimited.

3. American Express Gold Card

The American Express Gold Card is another excellent option, especially for foodies. It offers 4 points per dollar at restaurants, including takeout and delivery, and 3 points on flights booked directly with airlines. The rewards can be redeemed for travel through the Amex travel portal or transferred to various airline partners.

4. Capital One Venture Rewards Credit Card

The Capital One Venture card is known for its simplicity and value. Cardholders earn 2 miles per dollar on every purchase, with a straightforward redemption process that allows for easy travel bookings.

Strategies for Earning More Rewards

- Maximize Your Spending Categories: Use the card that offers the highest rewards rate for each category of spending. For example, use the Chase Sapphire Preferred for dining and travel, while using a different card for groceries if it provides better rewards.

- Take Advantage of Sign-Up Bonuses: Plan your spending strategically to meet sign-up bonus requirements, especially if you have a significant purchase coming up.

- Utilize Shopping Portals: Many credit card companies have shopping portals that offer extra points for shopping at specific retailers. Always check the portal before making online purchases.

- Refer Friends: Some credit cards offer referral bonuses when you refer a friend who is approved for the card.

- Pay Attention to Promotions: Keep an eye on promotional offers for bonus points on certain categories or retailers.

Redeeming Your Rewards

Redeeming your travel rewards can be just as important as earning them. Here are some tips:

- Book in Advance: Flights and hotel rooms can be booked well in advance, allowing you to find the best redemption rates.

- Be Flexible: If you can adjust your travel dates or destination, you may find better deals or availability for award bookings.

- Transfer Points: If your card allows it, consider transferring points to airline or hotel partners for potentially higher value redemptions.

- Use Travel Portals: Some credit card companies have travel booking portals that can offer discounts or bonus points for using your card to book.

Conclusion

Earning credit card travel rewards can significantly enhance your travel experience and help you save money on your adventures. By choosing the right card, maximizing your earning potential, and redeeming your rewards wisely, you can turn everyday spending into unforgettable travel experiences. Whether you prefer the Chase Sapphire Preferred for its transfer options or the simplicity of the Chase Freedom Unlimited, finding the right balance and strategy can lead to incredible rewards. Happy travels!